Pet Insurance Is Gaining Traction

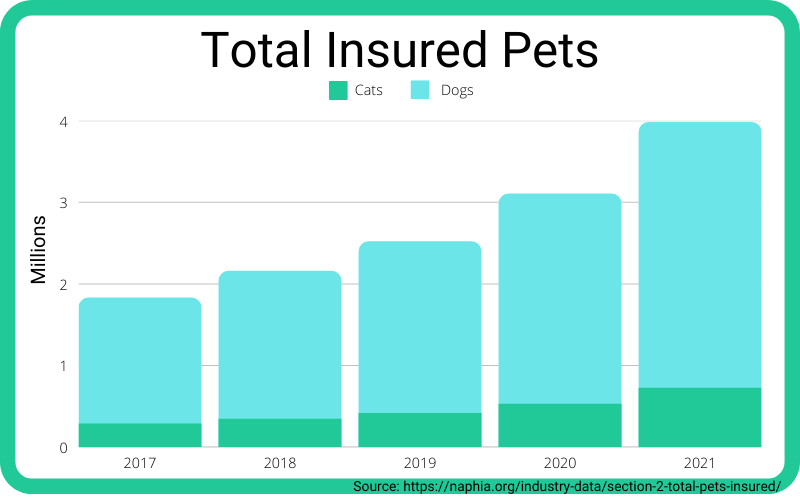

As Americans, we love our pets, and more and more, we’re showing that love by signing them up for pet insurance. In 2021, nearly four million pets were covered by pet insurance. That’s a 28.3% bump from 2020 (3.1 million pets) and nearly twice as many pets as covered in 2017.

As a group, dog owners are more likely to buy pet insurance than cat owners. Even though the number of cats insured has increased 2.5X since 2017 (that’s 290k to 727k), cats' share of total pets covered has never gone higher than 18.3% each year.

Dogs tend to be more expensive at the vet's than cats, partially because they can have higher treatment costs and partially because—as a result of being outside more often—they're more likely to become injured or sick. As a result, dog owners are more likely to see a faster return on their investment by purchasing pet insurance.

How Does Pet Insurance Work?

Pet insurance is a financial safety net that kicks in whenever your pet is sick or injured. Although it’s like human health insurance in the sense that you’ll choose a plan, pay a monthly premium, and have a deductible, there are a few key differences in how pet insurance works.

- People don't buy pet insurance just for the dollar-value. In our research, people valued having peace of mind for their pet's health nearly as highly as being able to save money at the vet's.

- Pet insurers usually don’t have networks. When your pet is hurt or sick, you can take them to your local family vet, urgent care, or animal hospital for treatment without worrying about whether the provider is in-network or not.

- Pet insurance is reimbursement-based. Most veterinary practices don’t bill pet insurance companies directly. Instead, you’ll pay the vet up front and use an itemized bill and receipt to submit a claim to your insurer.

- Most plans don’t cover pre-existing conditions. It’s why it’s a good idea to get pet insurance when you have a young and healthy pet; treatment for any injuries or illnesses they have before their coverage plan kicks in may not be covered.

- There’s a waiting period after enrollment before coverage starts. This is to prevent someone from signing up for coverage right when they need it (an expensive surgery, for example) and then canceling their policy right after. In order for insurance companies to afford to pay for sick or injured pets, they need to offset costs by collecting premiums from healthy ones.

Waiting periods vary by insurer, plan type, and even condition. Most plans have a 14-day waiting period before the insurer will start reimbursing customers for any treatment, but that can go up to 30-days depending on the insurer, or longer for certain conditions like hip dysplasia.

What Pet Insurance Looks Like In Action

First, you’ll compare quotes—it’s best to get options from a few different companies—and choose the right insurer for you and your pet’s needs (don't worry: we’ll go into this process next).

Once a month, you’ll pay a monthly premium to your insurance company. When you visit the vet, you’ll typically pay the invoice out of pocket (unless your vet has direct billing, which is rare).

Before paying, ask for an itemized bill and a receipt, and use this to submit a claim to your insurer. After they review your policy and coverage, they’ll cut you a check.

And…that’s it! Pet insurance is designed to simplify your life as a pet parent. As long as you keep records of your vet bills and pay your premium on time, your pet insurance coverage will work its magic from behind the scenes.

What Goes Into A Pet Insurance Quote?

When you request a quote from a pet insurance company, they look at multiple factors. Ultimately, your quote will be highly personal and tailored to your specific needs. Generally speaking, pet insurers look at these four variables:

#1: What Kind of Pet Do You Have?

The features that make your pet unique also affect the cost of your pet insurance. Here’s what pet insurance underwriters look at when building a quote:

- Species: As a rule of thumb, cats will almost always be cheaper to insure than dogs. Cats are more likely to be indoor-only, which means they're less likely to be injured and so don't need to visit the vet as often. Also note that while there are pet insurance companies that cover exotic pets such as rabbits, birds, and reptiles, most only provide coverage for dogs and cats.

- Breed: Your dog's or cat's breed heavily impacts how likely they are to develop chronic injuries and illnesses later in life. As a result, specific breeds may incur higher (or lower) premiums.

According to Money.com, the annual premium costs for Rottweilers, Doberman Pinschers, and both English and French Bulldogs can be double those of Yorkshire Terriers, Dachshunds, and Australian Sheepdogs. - Age: If you're starting a new policy, it pays off to sign up with a younger pet, as they're typically cheaper to insure than an older pet. They’re usually healthier and don’t have the same difficulties that come with old age.

#2: What Kind of Plan Do You Need?

When comparing plans, you’ll commonly see three types of pet insurance coverage: accident-only, accident and illness, and preventative.

- Accident-only: This coverage plan only pays for vet bills associated with injuries that are, well, accidents. For example, this kind of plan kicks in if your pet gets stung by a bee, eats a chocolate bar, or breaks their leg.

- Accident and Illness: As the name suggests, this plan is one step up from the previous type and protects against both injuries and illnesses. It’s a popular choice because of its long-term protection of your pet, covering illnesses from ear infections and kennel cough to hypothyroidism and some cancers.

- Preventative: This plan is usually offered as an add-on package and is designed to help your pet stay in ideal health. Coverage includes most preventative care, like check-ups, teeth cleanings, and immunizations.

Accident-only plans are the most affordable since they offer the least coverage, while a policy that has preventative care on top of accident and illness coverage will be on the more expensive side.

#3: How Will You Customize Your Plan?

Many pet insurance companies offer plan-by-plan customization options, making your coverage and subsequent premium pricing completely unique to you. When comparing plans side-by-side (either from the same company or between different ones), keep an on these factors:

- Deductible amount: This is how much you have to pay out of pocket before your insurance starts paying towards your pet’s veterinary care. Deductibles can be anywhere from $0 to $3,000+, but usually are between $100 and $500 per term.

- Reimbursement rate: The reimbursement rate is what percent of the bill that the insurer will cover. Most companies will offer a 90% reimbursement rate, but you can lower your premium by choosing a reduced rate like 80%, 70%, or lower.

- Year or lifetime limit: Some pet insurance plans come with year or lifetime limits, in which the insurer will stop paying for medical bills after you reach that cap.

These can be based on total coverage or they can be condition-specific; some plans will have a limit specifically on dental treatments (e.g., up to $1,000 per year) but have an unlimited payout for the rest of your plan.

Customization options affect your pricing in different ways. The lower your reimbursement rate and year/lifetime limit, the lower your out-of-pocket premium costs will be. Alternatively, the lower your deductible, the higher your out-of-pocket premium costs will be.

This means that you can create a pet insurance policy that is custom-tailored to your budget and needs. If you get a quote from a pet insurance company and the premium feels high, you can try adjusting some of these factors to end up with a plan that better suits your budget.

Price Point #4: Where Do You Live?

Just like how insurance companies look at your pet’s age and breed to determine whether it’s likely they’ll develop an expensive healthcare condition, they look at your address to see if your local vets are more or less expensive than average. More populated cities are more expensive than less populated cities—a higher cost of living usually means more expensive vet bills, thus higher premiums.

An insurance underwriter will consider how risky your local area is, and how likely it is that your pet might be injured. This depends largely on what kind of environmental hazards are around you (wildlife, traffic, high-rises, etc.) and how common they are.

We don’t suggest moving just to cut down on your pet insurance premiums, but if you’re comparing quotes between two cities and see a difference in cost without any other change in coverage, location could be the reason for the discrepancy.

How Much Does Pet Insurance Cost?

According to the North American Pet Health Insurance Association (NAPHIA), in 2021 the average premium for dog insurance was $19.93 per month for an accident-only policy and was $48.66 per month for an accident and illness policy.

As we’ve mentioned, these prices are highly dependent on multiple factors including location, type of pet, and policy type. We can see this just by comparing the average cost of dog insurance to the cost of cat insurance. In 2021, the average premium for cat insurance was only $28.57 per month for an accident and illness policy.

While we’re not going to use these averages to comment on the cat vs dog debate, we want to point out that what pet insurance plan is right for you really depends on what you need.

For some families, an accident-only plan has enough coverage. For others, the accident and illness plan makes more sense. What it comes down to is looking at how much you would expect to spend on your pet’s healthcare without pet insurance and comparing it to what your total out-of-pocket would be with pet insurance.

To help illustrate what we mean, let’s look at a case study: Sparky, the golden retriever.

Case Study: Sparky

Sparky is a five-year-old golden retriever living in sunny Reno, Nevada. He’s in good health, and he doesn’t have any pre-existing conditions.

We want to compare how much three vet bills would cost Sparky’s owner in two scenarios: one where he is paying entirely out of pocket and one where he has pet insurance coverage.

For the insurance side of things, we’ll use a policy with these terms:

- Accident and illness coverage

- 90% reimbursement rate

- $500 deductible

- $10,000, one-year term limit

- $50 per month premium

The premium is slightly higher than the national average, but Sparky has a good pet insurance policy; all of the vet bills we’re about to give him are fully covered.

Treatment #1 - Kennel Cough

Sparky has good pet insurance coverage, but he’s unlucky and he catches kennel cough from the dog park. Kennel cough is a contagious disease that can cause runny eyes and sneezes as well as its characteristic cough. Treatment costs range between $75–$200, though additional lab work or testing can add $200–$500+ onto that.

Sparky had a pretty bad case—it cost $300 in total to treat. Since his deductible for the year is $500, his owner is still out of pocket for the full $300, plus the premium costs.

Treatment #2 - A Chocolate Bar

Chocolate is poisonous to dogs; it has a caffeine-like chemical that they can’t process easily. When Sparky helps himself to an unattended, large chocolate bar, he needs to be seen by a vet immediately.

If he’s seen quickly, the cost of treatment is minimal: $300-$600. A bad case of chocolate poisoning can require extensive care and easily cost upwards of $2,000.

In Sparky’s case, his owner takes him to the vet quickly, so the total treatment only costs $500. For an uninsured Sparky, his owner has to pay the full cost of treatment. However, Sparky's second medical adventure has used his deductible for the year and his insurance is starting to kick in.

Treatment #3 - A Broken Leg

Unfortunately, a break in a dog’s leg can happen for a number of reasons, from taking a bad fall, playing too rough, or even being hit by a car. The costs for treatment can range between $200 and $5,000+, based on severity and whether the vet needs to run tests to look for additional damage or an underlying condition.

For Sparky’s sake, let’s say he’s all better for the total price of $2,500. On the insurance side, Sparky is well past using his deductible, and the insurance kicks in immediately, paying for 90% of his treatment costs.

Sparky’s Healthcare Summary

Now that we’ve seen how three vet bills would look like with and without coverage, let’s track how much was spent overall for the year, including premiums.

Cost of Coverage - One year

Even with the premiums added in, Sparky’s owner saved $1,920 by purchasing pet insurance well before Sparky first coughed.

So: Is Pet Insurance Worth It?

While only you can answer this for your own pet family, from our case study, we can see that all it takes is one bad accident to make pet insurance worth it.

For a lot of pet owners, having pet insurance is also less about making sure they get their dollar’s worth and more about making sure they’re never in the position of being at the vet’s office or emergency care, wondering if they can afford the bill.

That said, there are a lot of scenarios where getting coverage makes financial sense, and some scenarios where pet insurance alternatives are more cost-effective.

Consider getting a few quotes and comparing pet insurance plans. Coverage is a great idea if:

- After receiving your pet insurance quote, your annual premium payments either match or are lower than your estimated annual vet costs.

- You want to be able to get your pet the care they need without having to focus too much on the sticker cost of the veterinary bill.

- You prefer to make your pet’s healthcare a consistent, low expense (as in, paying monthly premiums) as opposed to an inconsistent, costly expense (as in, random illness/accident bills).

On the other hand, pet insurance coverage might not be right for you if:

- You’re looking to insure an older pet and the insurance premiums are more than you expect to pay in healthcare costs.

- You have access to low-cost veterinary care.

Choosing the Best Pet Insurance Company

If you’re ready to shop around for a few pet insurance quotes, look no further than our comparison site. After hours of research, we gathered a list of America’s best-rated pet insurance providers. Every company is well-reviewed and accepted by veterinarians nationwide.

From our site, you can easily request pricing quotes from multiple pet insurance companies, meaning you can compare your sticker price and coverage to end up with the best plan for your scenario.